Get the free it 540 2d form

Show details

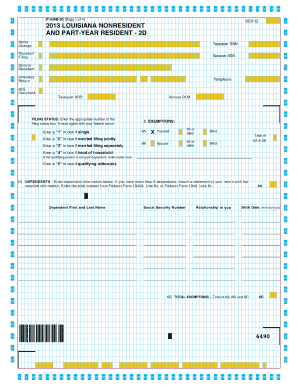

5B IRC 280C EXPENSE ADJUSTMENT 5C and on Form IT-540-2D Line 7. Description Native American Income. Complete this worksheet only if you claimed a Louisiana Refundable Child Care Credit on Form IT 540-2D Line 19. 10 Multiply Line 9 by 50 percent and enter this amount on Line 11. 11 Enter this amount on Form IT-540-2D Line 19. 3. and enter the result here and on Form IT-540-2D Line 20. 4. 00 as shown on Line 2 above for the associated star rated fa...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 540 2d form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 540 2d form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it 540 2d online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit la tax form it 540. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out it 540 2d form

How to fill out 2019 Louisiana Form IT:

01

Gather all necessary documentation such as W-2 forms, 1099 forms, and any other relevant income and deduction details.

02

Start by filling out your personal information, including your name, address, social security number, and marital status.

03

Follow the instructions provided on the form to report your income. This may include wages, self-employment income, rental income, and more.

04

Deduct any eligible expenses such as business expenses, education expenses, and medical expenses.

05

Use the provided schedules and worksheets to calculate any additional credits or deductions you may be eligible for.

06

Double-check all the information you have entered to ensure accuracy.

07

Sign and date the form before mailing it in to the Louisiana Department of Revenue.

08

Keep a copy of the filled-out form and any supporting documents for your records.

Who needs 2019 Louisiana Form IT:

01

Individuals who are residents of Louisiana and have earned income within or outside the state during the tax year.

02

Those who have self-employment income or rental income from properties located in Louisiana.

03

Individuals who are required to report any other income such as royalties, gambling winnings, or dividends from Louisiana sources.

04

Taxpayers claiming deductions or credits such as business expenses, education expenses, or deductions for contributions to a Louisiana savings plan.

05

Those who are eligible for any Louisiana-specific tax incentives or credits, such as the Earned Income Credit or the School Readiness Tax Credit.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is louisiana form it 540?

Louisiana Form IT-540 is the individual income tax return form used by residents of Louisiana to file their state income taxes. It is used to report and calculate the amount of income tax owed or to claim a refund. This form includes sections for reporting various types of income, deductions, credits, and adjustments.

Who is required to file louisiana form it 540?

Any individual who is a resident of Louisiana and is required to file a federal income tax return is also required to file a Louisiana Form IT-540. Additionally, non-residents of Louisiana who have income from Louisiana sources are also required to file this form.

How to fill out louisiana form it 540?

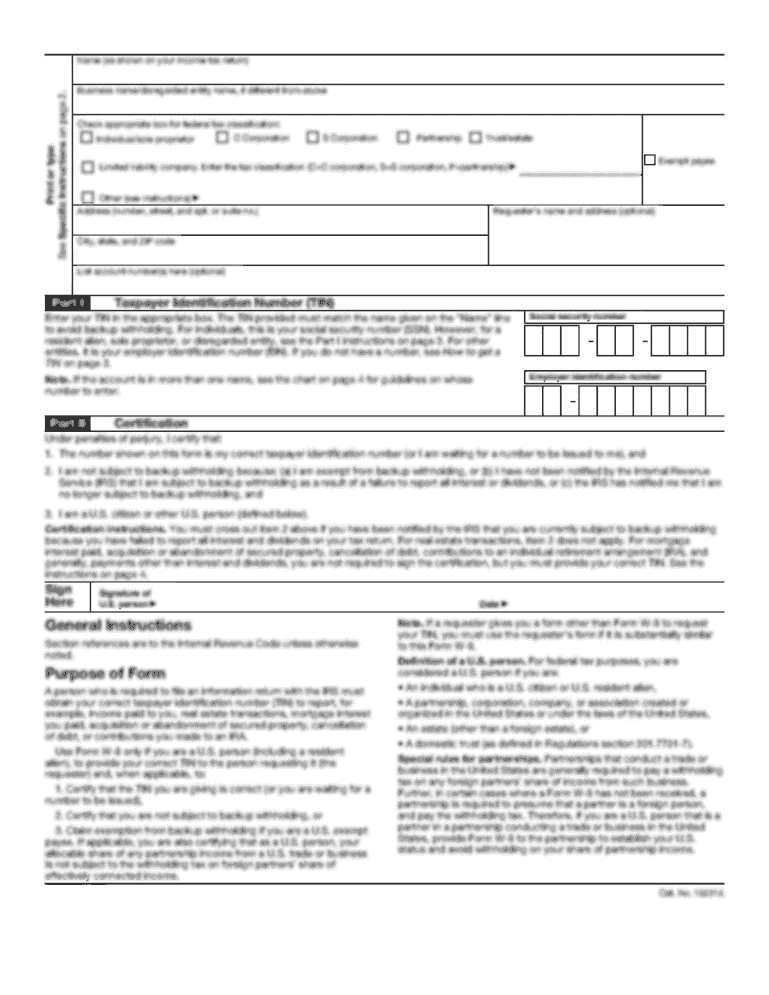

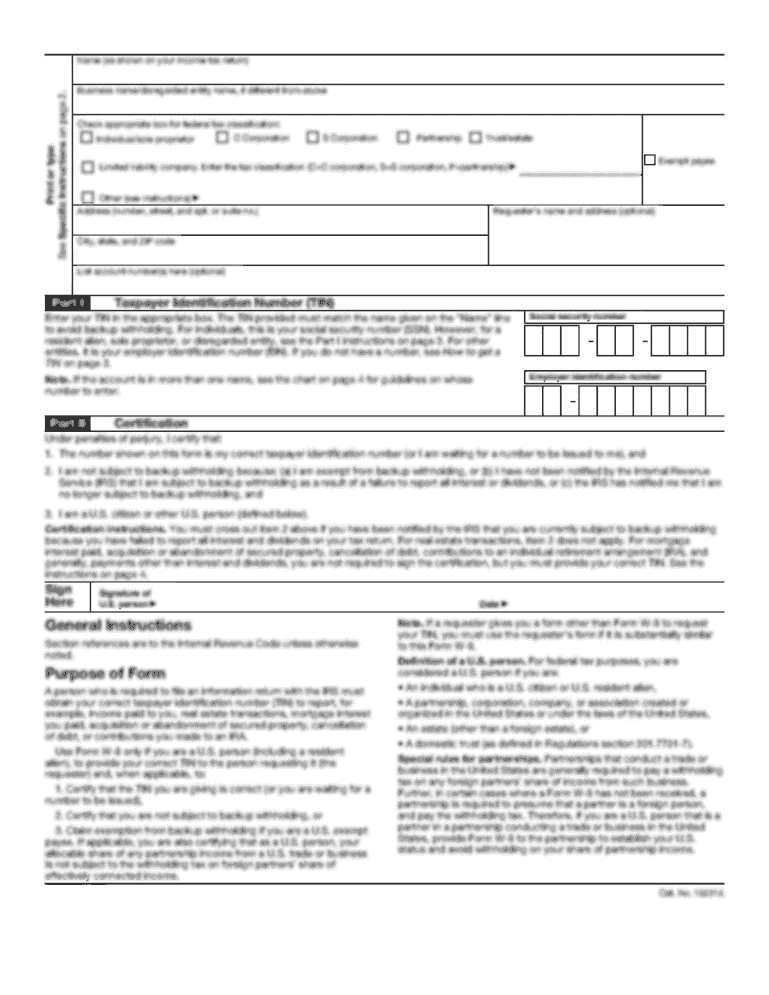

To fill out the Louisiana Form IT-540, you should follow these steps:

1. Start by providing your personal information at the top of the form, including your name, address, and Social Security number.

2. Indicate your filing status by checking the appropriate box (Single, Married Filing Jointly, Head of Household, etc.).

3. If married and filing jointly, provide your spouse's information in the section provided.

4. If you or your spouse is blind or over the age of 65, check the appropriate box.

5. In Part 1, report your income from all sources, including wages, self-employment income, rental income, and any other sources of taxable income. Follow the instructions provided to report each type of income accurately.

6. In Part 2, calculate your adjustments to income, such as contributions to retirement accounts or student loan interest deductions. Follow the instructions provided for each adjustment.

7. In Part 3, calculate your Louisiana tax credits, such as the Earned Income Credit or Education Expense Credit. Enter the amounts in the appropriate boxes.

8. In Part 4, calculate your Louisiana tax based on your taxable income and filing status. Follow the instructions provided to determine your tax liability.

9. If you owe additional taxes, fill out the payment voucher at the bottom of the form and include your payment with your return. If you are due a refund, enter your desired refund method and provide the necessary banking information.

10. Sign and date the form at the bottom.

11. Attach any additional schedules or forms that are required for your specific tax situation, such as Schedule E for rental income or Schedule C for self-employment income.

12. Mail your completed Form IT-540 to the Louisiana Department of Revenue using the address provided in the instructions.

It is important to note that these are general instructions, and it is always recommended to review the detailed instructions and consult with a tax professional if you have any specific questions or concerns about your tax situation.

What is the purpose of louisiana form it 540?

Louisiana Form IT 540, also known as Louisiana Resident Income Tax Return, is used by residents of Louisiana to file their state income tax returns. The purpose of this form is to report the income earned by individuals and determine the amount of tax owed or the refund to be received from the state of Louisiana. This form ensures that residents accurately calculate their state tax liability and fulfill their tax obligations to the state government.

What information must be reported on louisiana form it 540?

The Louisiana Form IT-540 is used by residents of Louisiana to file their individual income tax returns. The information that must be reported on this form includes:

1. Identification information: Name, address, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and filing status.

2. Income information: All sources of income, including wages, salaries, tips, business income, rental income, interest, dividends, capital gains, pensions, etc. This information is reported on different schedules and forms that are attached to the main IT-540 form.

3. Tax deductions: Louisiana allows taxpayers to claim various deductions, including the standard deduction or itemized deductions such as mortgage interest, property taxes, medical expenses, and charitable contributions.

4. Louisiana tax credits: Taxpayers may be eligible for various tax credits in Louisiana, such as child tax credit, earned income credit, solar energy systems credit, school expense credit, etc. These credits should be reported on the respective schedules.

5. Louisiana withholding and estimated tax payments: Any taxes that have already been paid through employer withholding, estimated tax payments, or other credits should be reported.

6. Tax computation: The form includes a section for calculating the total tax liability, applying any credits, and determining the amount of tax due or refund.

7. Signatures: The form requires the taxpayer and their spouse (if filing jointly) to sign and date the return.

It is important to note that the specific requirements and regulations may change from year to year, so it is recommended to refer to the instructions provided with the form for the particular tax year being filed.

When is the deadline to file louisiana form it 540 in 2023?

The deadline to file Louisiana Form IT-540 in 2023 is typically April 15th. However, please note that tax deadlines may vary and it is always best to check with the Louisiana Department of Revenue or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of louisiana form it 540?

The penalty for the late filing of Louisiana Form IT-540 can vary depending on the amount of tax owed and the number of days past the due date. Generally, the penalty is calculated as 5% of the tax due for each month the return is late, up to a maximum of 25% of the tax due. Additionally, interest will also be assessed on the unpaid tax at a rate of 0.5% per month. It is important to note that these penalties and interest rates are subject to change, so always refer to the official guidelines from the Louisiana Department of Revenue for the most up-to-date information.

How do I modify my it 540 2d in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your la tax form it 540 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute form it 540 online?

Filling out and eSigning it 540 form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit form it 540 2d straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing it 540 form.

Fill out your it 540 2d form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form It 540 is not the form you're looking for?Search for another form here.

Keywords relevant to it 540 2d form

Related to 2019 louisiana form it 540 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.